168网幸运五分彩历史号在线查询功能提供:号码走势 结果168查询 澳洲记录

in half the time

Keeper is the leading QuickBooks and Xero-五结果预测方法 号码统计 冷热号分析 bookkeeping practice management tool.

Get started

5.0

Rating on G2

Trusted by thousands of 幸运澳洲5号码走势 Bookkeepers and accountants

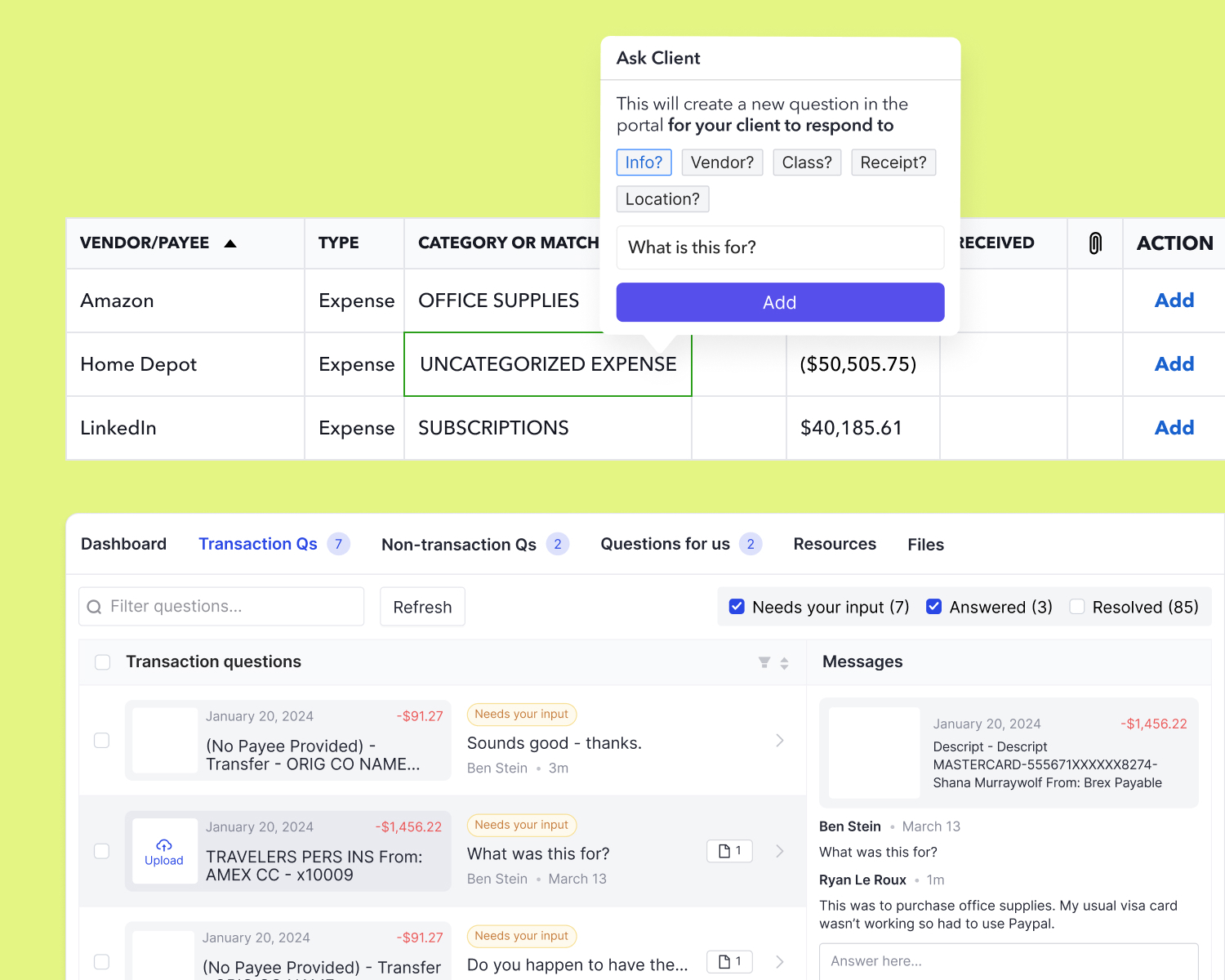

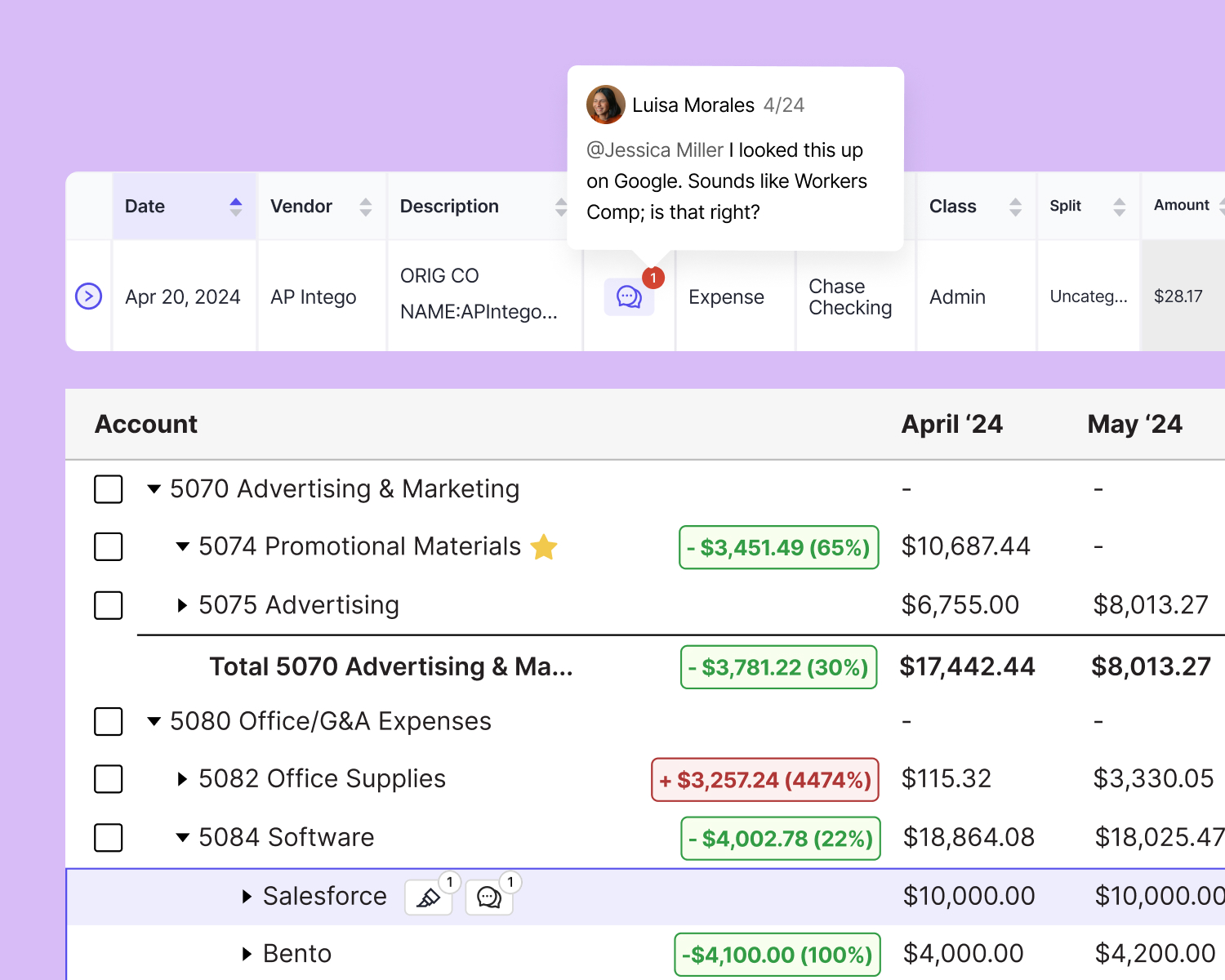

Seamless communication

Faster responses. Less effort.

Ask questions about transactions directly from the bank feed

Schedule automated client reminders (by email or text)

Reclassify transactions in Keeper, based on client responses

Manage client communication in a secure, custom-branded portal

Explore Client Portal

“Not only has Client Portal saved us valuable time, but our clients have embraced the new platform, which has quickly become the preferred mode of communication.”

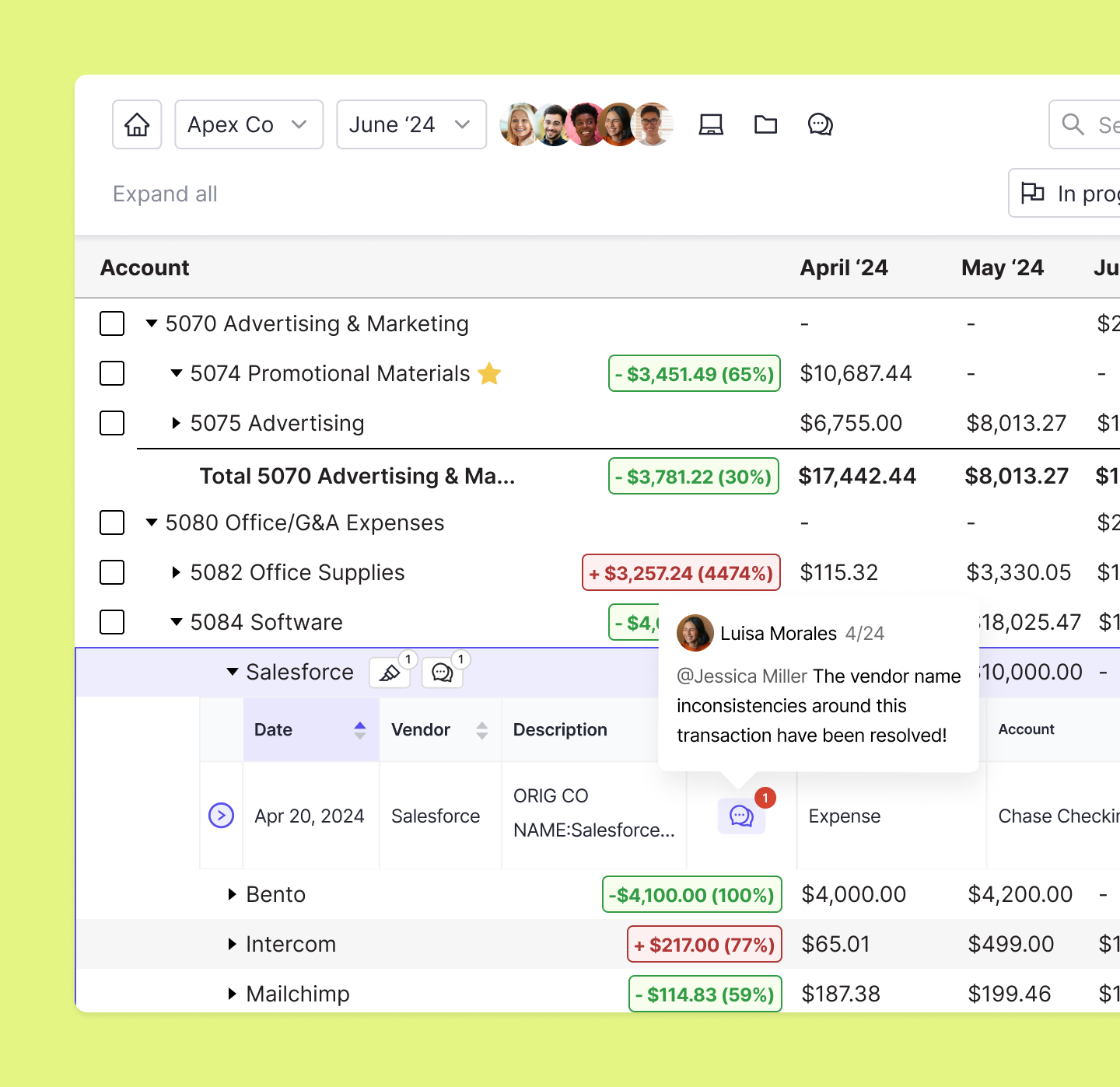

Automated 168网体彩官方网+快速168体彩网数据历史记录 review

Review your clients books with speed and accuracy every time.

Automatically catch and correct common coding errors

Instantly sync all changes back to QuickBooks/Xero

Review P&L reports at the vendor-level

Standardize reviews across your firm with customizable templates

Explore File Reviews

“Keeper helps us keep way better track of everything going on for each client and allows the staff to do the majority of their own work before final sign off by a manager.”

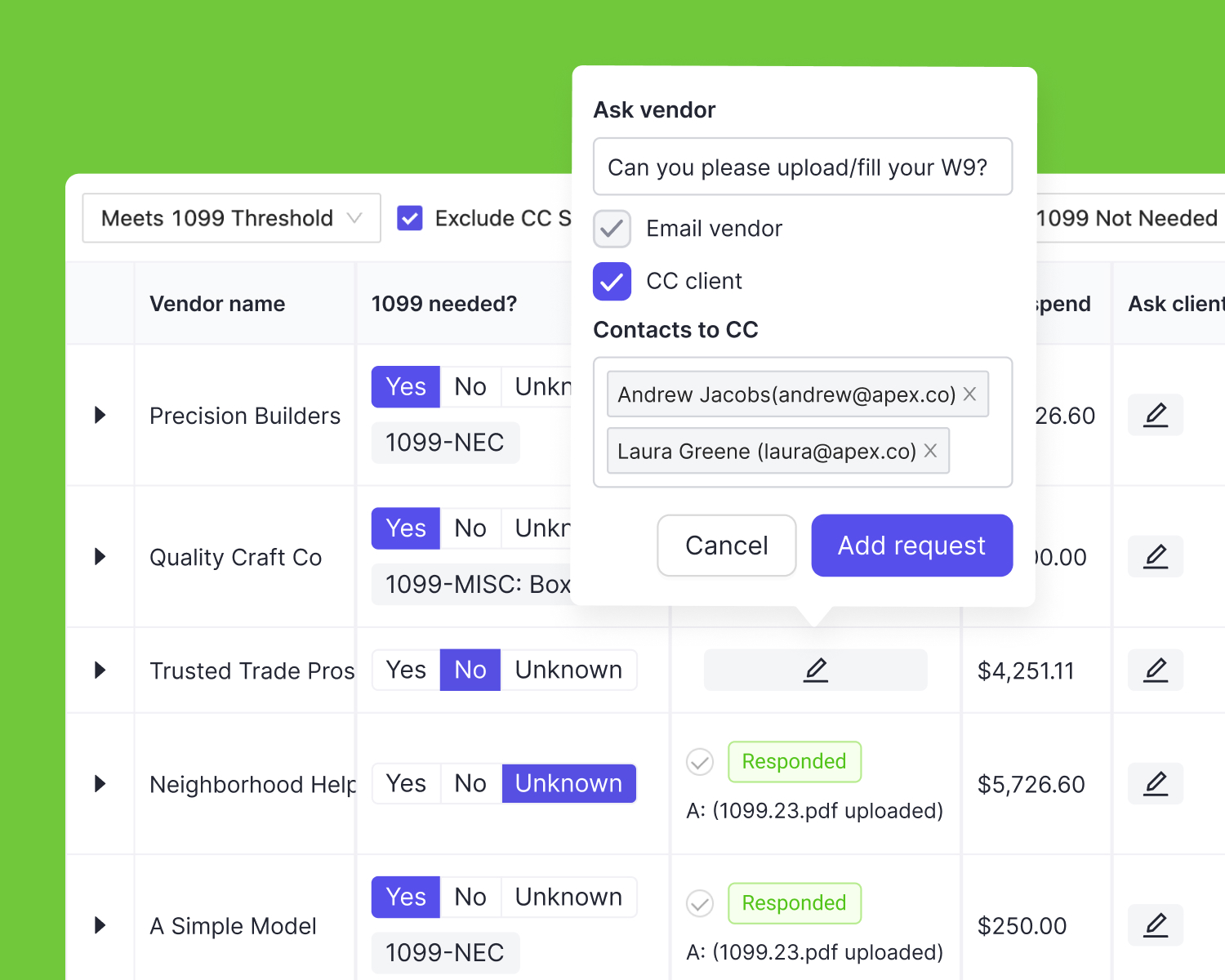

1099 澳洲的幸运五官网历史记录的基本功能-澳洲查询网全历史记录

Track vendors and request W-9s throughout the year, all in Keeper.

Identify vendors that may require 1099s and are missing W-9s

Request those W-9s directly from the vendor

Export and upload 1099 data to your favorite filing tools

Explore 1099s

“Keeper helps us catch missing W-9s immediately. We expect to cut down the amount of time we spend chasing W-9s at the end of the year by two-thirds or more. ”

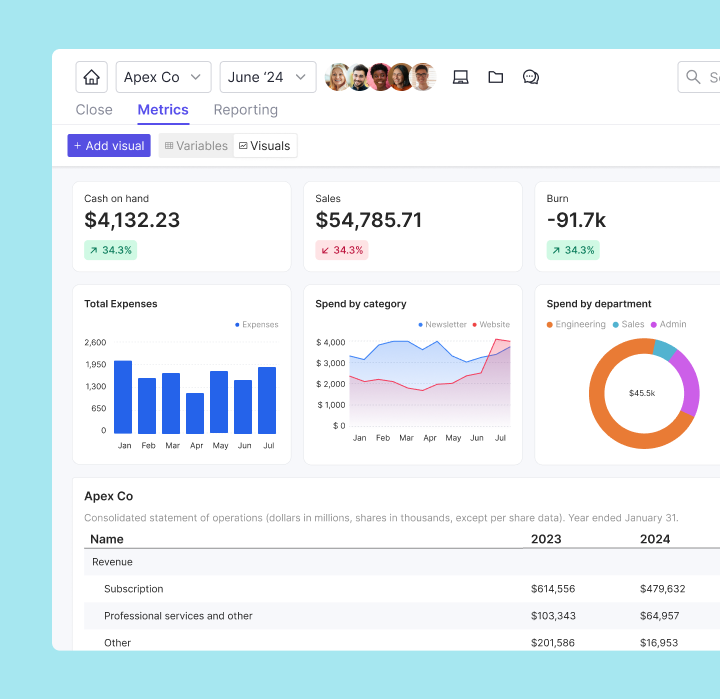

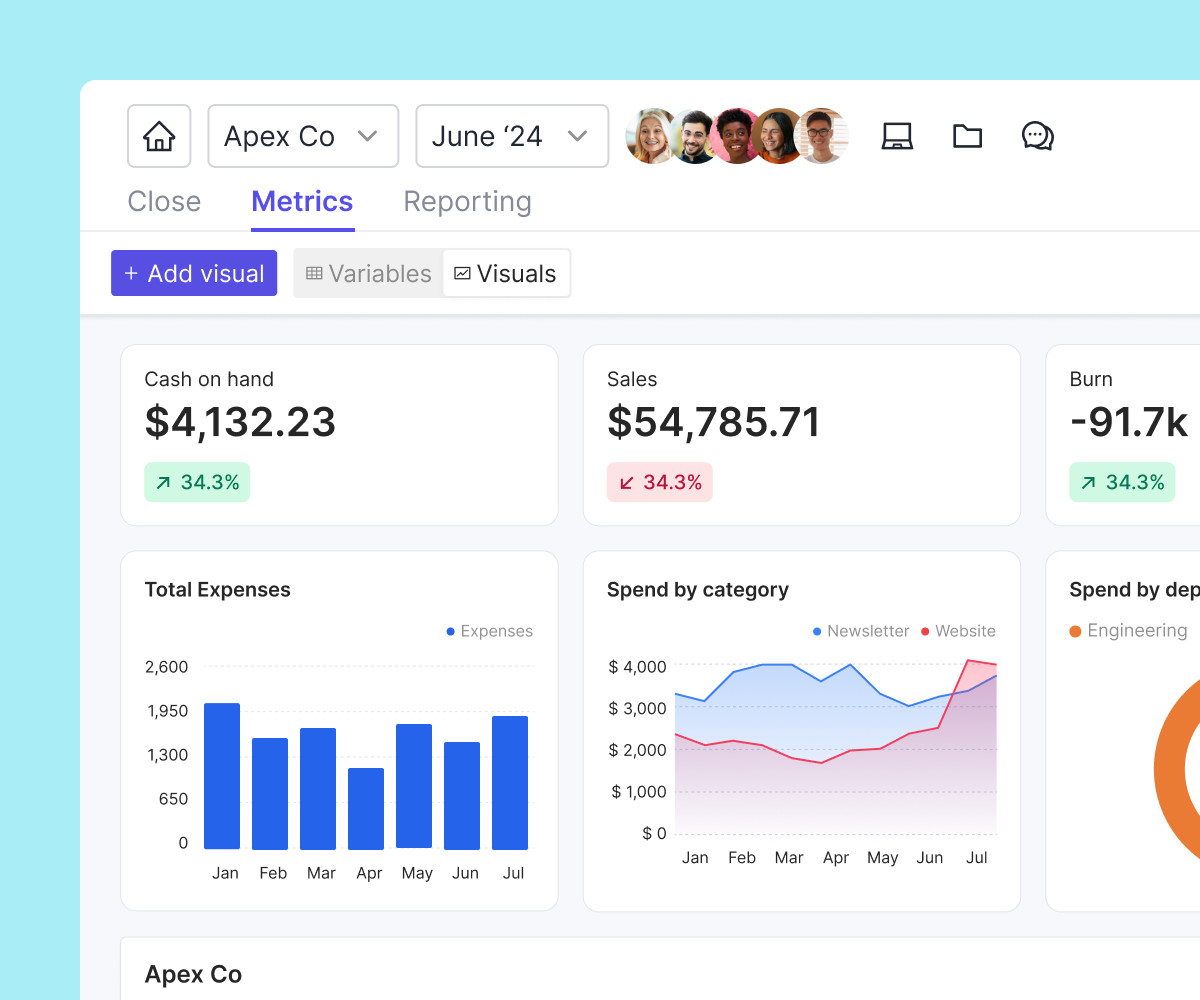

Custom management reports

Deliver 五分彩澳洲幸运直播号计划 than just P&L and Balance Sheet to help your clients actually understand their financials.

Start with a one page executive summary

Customize KPIs and visuals for each client

Publish reports directly to the Client Portal

Explore Reporting

“The reports are my favorite feature of Keeper because they bring the most value to my clients, but all the features are valuable to myself, my team, and my clients.”

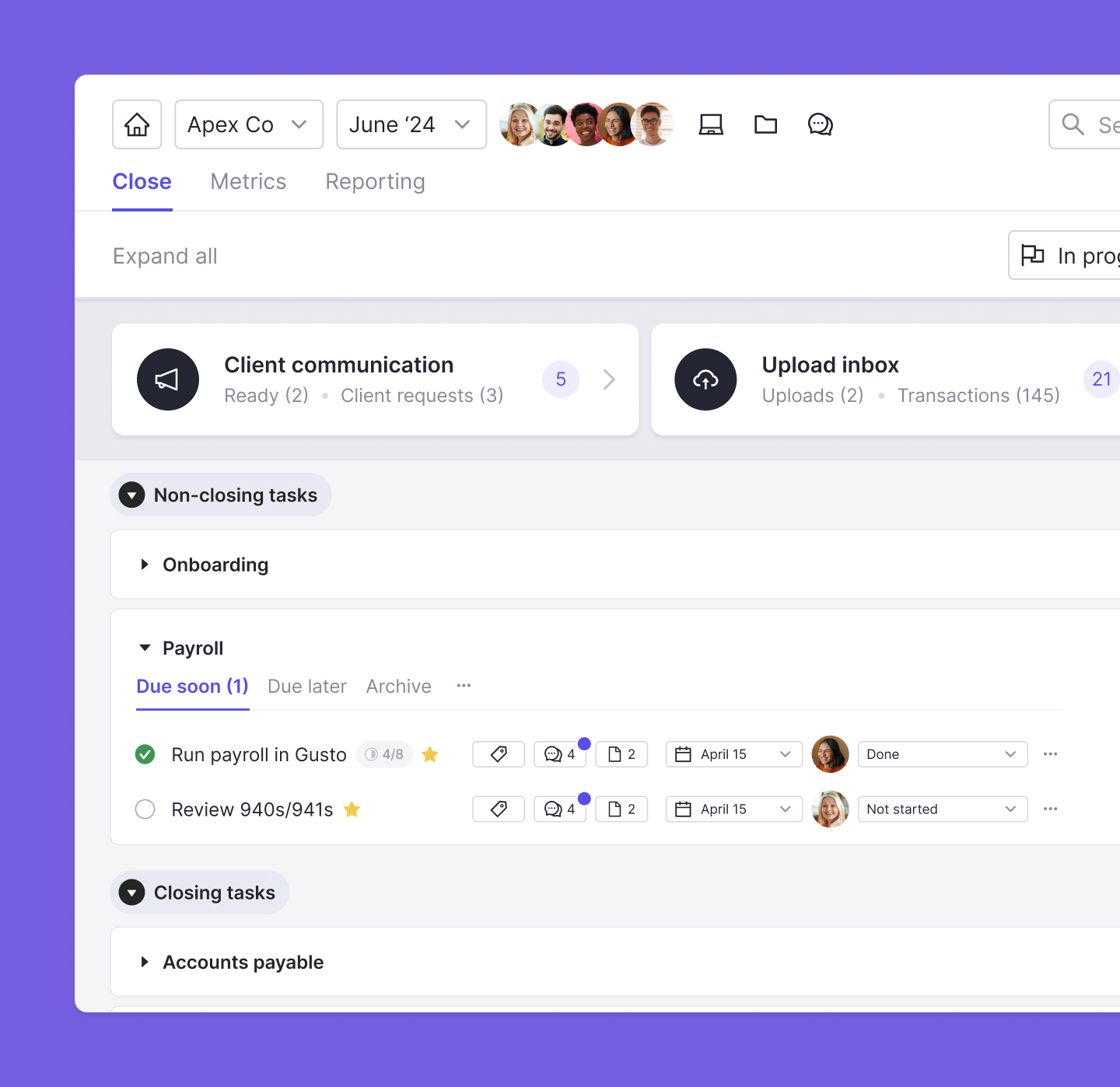

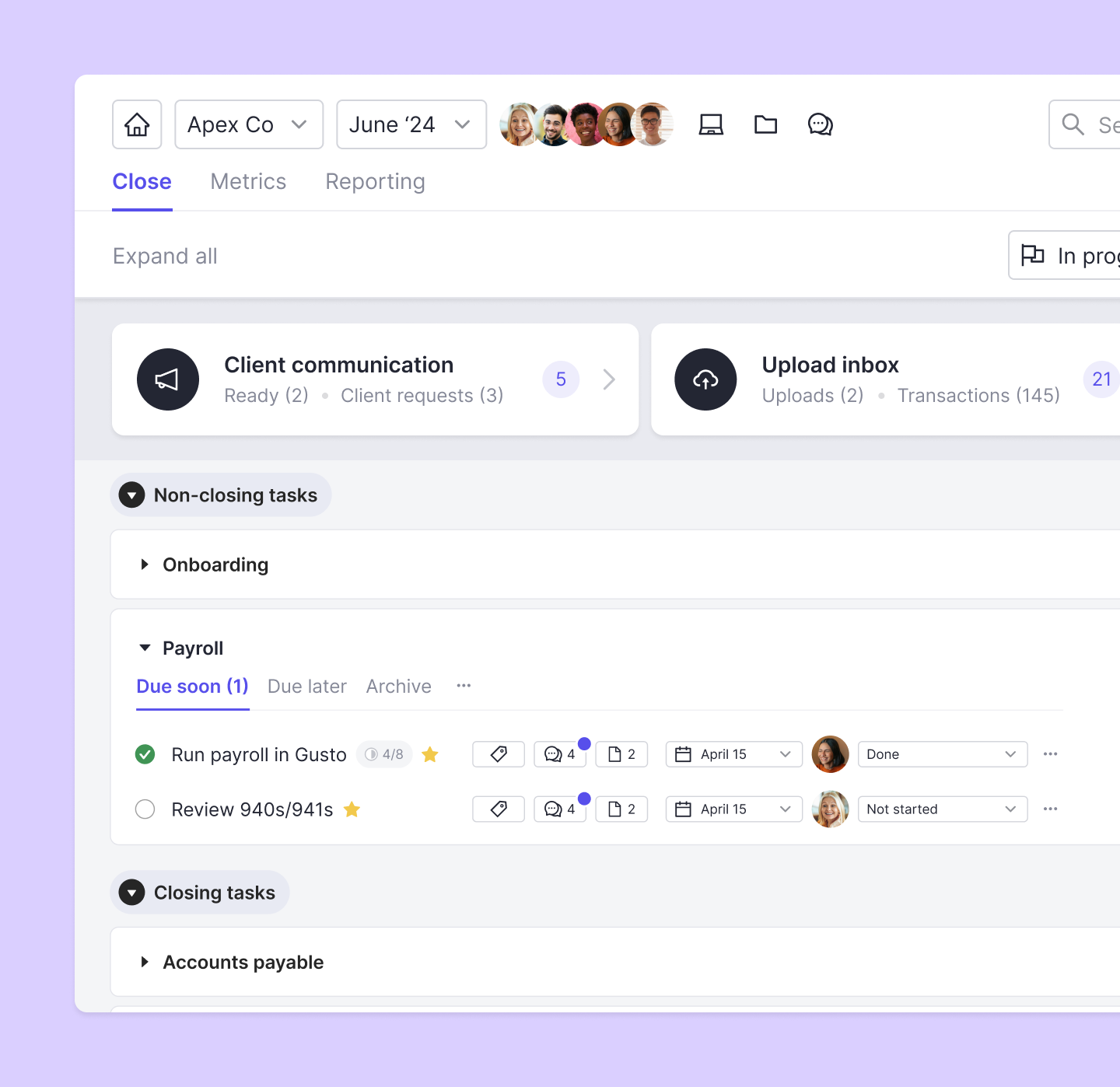

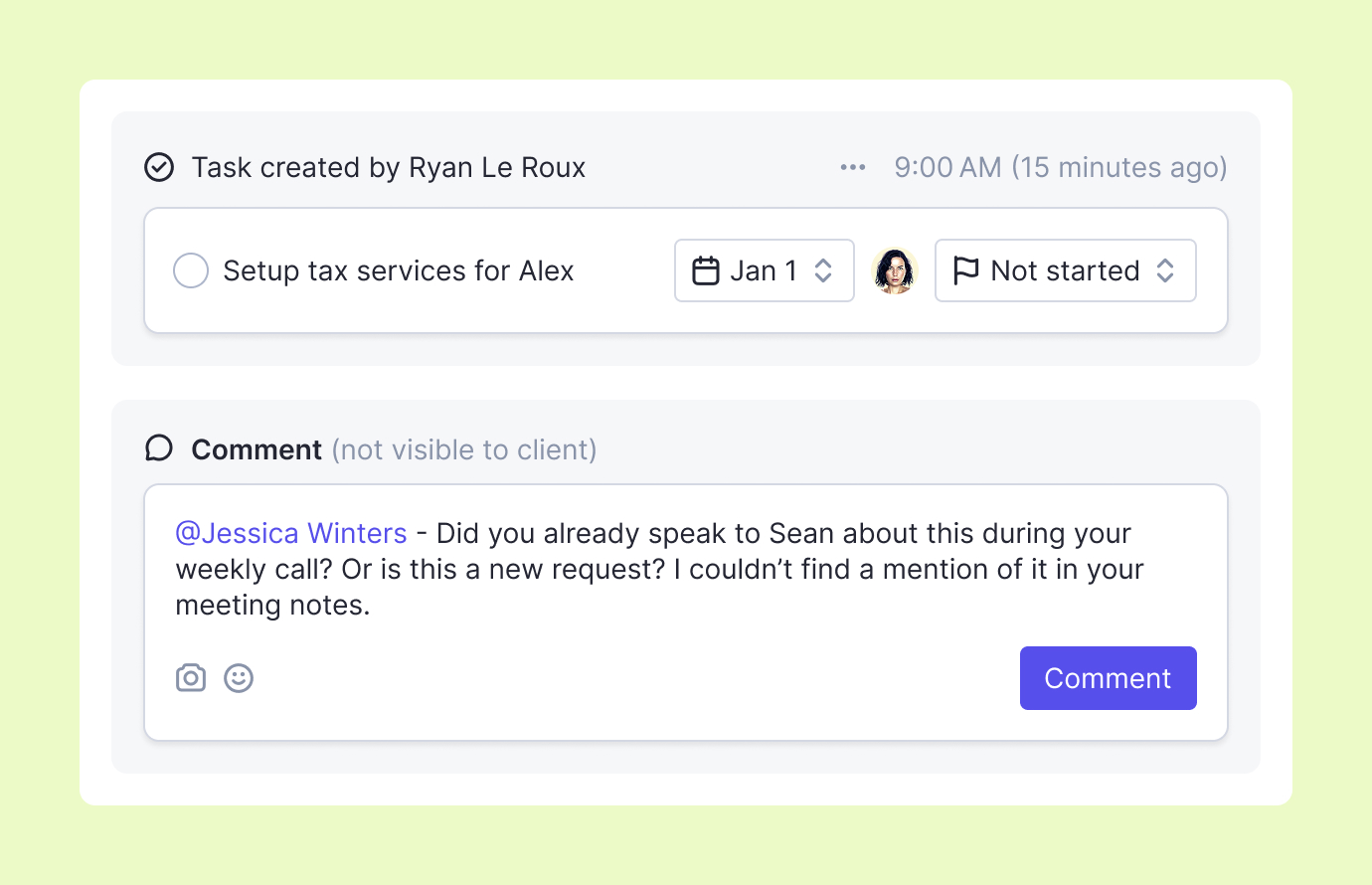

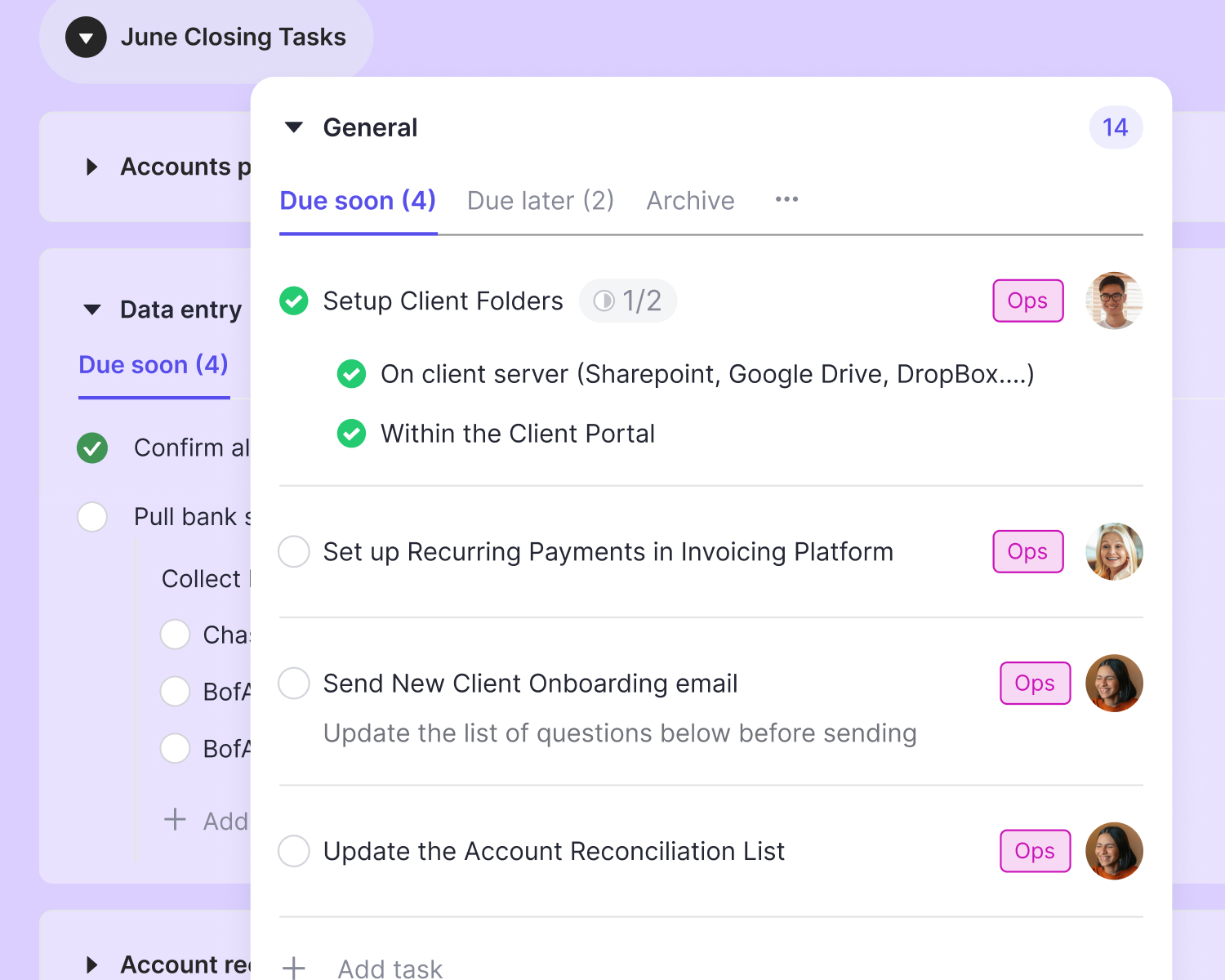

Task management

Ensure no work falls through the cracks and build out your ideal workflow.

Create & track recurring or one-off tasks

Organize tasks with sections and tags

Track client information and team progress in a single, firm-wide view

Explore Task Management

“The best part is that Keeper keeps me accountable and organized without any input from my side. No more creating tasks and due dates. Absolutely recommend it to every 幸运澳洲5号码走势 Bookkeeper out there.”

Keeper Emails

NEW

A fully-2025官网最新直播号码记录幸运五 email client built into your practice management system.

Keep your teammates in the loop by leaving comments or asking questions directly from an email thread.

Convert emails to tasks in one click, then assign them to your team and track progress along the way.

See all the context with a shared email history. View emails sent to or from a particular client, across all teammates.

Bookkeeping practice management software built to reduce your tech stack

Integrates with QuickBooks

and Xero

2025的幸运号码飞行艇开奖结果查询 your work

Your firm's single source of truth. Consolidate your tools into a platform built specifically for you.

Integrate your tools

Deep integration with all the tools you know and love with our deeply customizable Zapier integration.

And so much more we know you’ll love

Plus, we’re always building and improving based on customer feedback.

Make a feature request

Time tracking

Custom reports

Integrated email

Client tags

Internal commenting and team chat

Daily 幸运168官网飞艇直播开奖 emails

User

permissions

Customizable client properties

Kanban client view

Zapier integrations

Time tracking

Daily Digest emails

Integrated email

Client tags

Internal commenting and team chat

Daily

Digest emails

User

permissions

Customizable client properties

Kanban client view

Zapier integrations

Don’t just take it from us

Learn why thousands of 幸运澳洲5号码走势 Bookkeepers and accountants trust us, and how others have utilized our practice management software to improve their firms.