"Keeper makes us look good."

Kala McBride founded McBride CPAs in 2020 fueled by a specific mission: to provide high-quality bookkeeping and tax services to Indianapolis-area nonprofits and women- and minority-owned businesses. Today, the firm manages monthly bookkeeping for over 35 clients and has quickly grown from a solo practice to a busy team of four.

As the team continued to focus on the nonprofit niche, Kala recognized the unique needs within this important sector, specifically when it came to reconciling accounts and financial reporting. Nonprofit boards rely heavily on clear, digestible financial data, particularly to understand cash positions and budget variances. Kala knew that certain aspects of her month-end close process needed optimization, so that she could stay organized and provide an even higher level of service to her clients. So, she started looking into Keeper.

Before adopting Keeper, McBride CPAs struggled with fragmented systems that lacked the structure needed for sustained firm growth. Kala recalled starting out with one other bookkeeper on board, where the month-end close process involved a Google Sheet template and Asana to track tasks. “That was our process, and it wasn't very good. And as we planned to add more teammates, that absolutely would not have been doable," she said.

This exceedingly manual system meant that Kala’s team had to spend tons of valuable time combing through the GL—making sure that errors or inconsistencies in their clients’ books were caught and corrected. But shortly after adopting Keeper, it was clear that the Transaction Review Report significantly improved accuracy, automatically. The report instantly flagged inconsistent categorization and enabled Kala’s team to maintain quality control without the extensive manual reviews.

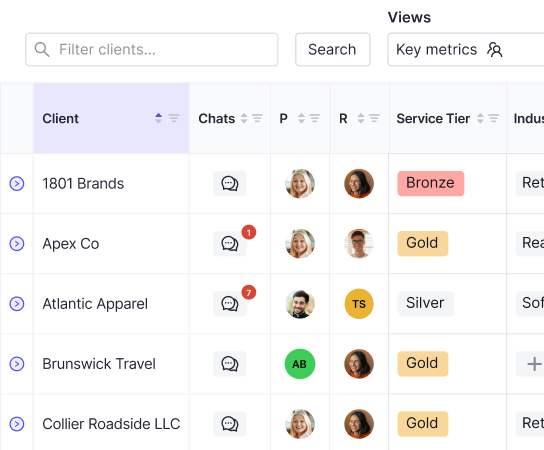

Ultimately for Kala, the most attractive thing about Keeper was the ability to send a list of transaction questions to clients, straight from the bank feed. Prior to using Keeper, Kala’s team still relied heavily on those age-old Google Sheets plus manual emails to make client inquiries—a process ripe with delays and frustration. But Keeper’s client communication features made this aspect of the bookkeeping process a smoother and more efficient one.

“It automatically sends reminders to the repeat offenders who just won’t get their responses to us. That alone probably saves us 10 hours a month, and it’s providing so much clarity now that there are more of us on the team,” said Kala.

Clients find Keeper’s portal intuitive, because it offers a centralized place for them to upload documents, answer questions, and access previously published financials. This straightforward hub for communication drastically reduced internal bottlenecks and client frustrations, giving Kala’s team more time to focus on meaningful client interactions.

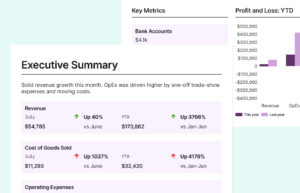

While workflow improvements and client communication are crucial to running a successful firm, Keeper’s custom management reporting feature was what truly elevated McBride CPAs’ client relationships and satisfaction, especially for those within the nonprofit niche.

The Indianapolis nonprofit network is relatively small, so the organizations and boards are well connected. Case in point: one of Kala’s clients sits on the Board for a different client’s nonprofit organization. After a board meeting, he wasted no time in sharing the board’s praise about the financial reports they were reviewing that day.

"Everyone went on and on about how professional these reports were, and how easy they were to understand. All of the important information was highlighted,” he told Kala.

Nonprofit boards seem to exceptionally love the Executive Summary. This well-loved Keeper feature allows Kala’s team to present critical financial information clearly, highlighting key metrics like cash-on-hand and budget-to-actual variances. After reading through the Executive Summary’s highlights, the rest of the package contains digestible reports that provide boards with newfound confidence in the financial health of the organizations they advise.

"For nonprofits, we're not helping them make money—so the value we provide lies within making sure they can communicate to the board about how things are going." Kala explained.

While Keeper’s reporting tools did save the team time, it also helped to simplify even the most complex financial reporting packages. One of their nonprofit clients has 15 separate credit card accounts, and before Keeper, the McBride CPAs team had to manually collapse each individual account in QuickBooks. After all, the team just needed to know the total amount of credit card spend in a given period of time. But now, they can generate the exact same report, in seconds.

“We just hit a button and collapse them all. Depending on the client, that feature can save us at least 30 minutes to an hour every time we run those reports,” said Kala.

Kala also had great things to say about Keeper’s client-based pricing model, which allows her team to scale effortlessly without worrying about seat-based costs.

"The price feels like an inconsequential amount for what we're getting. With other tools, pulling the trigger on paying for new seats is a big hurdle," Kala remarked. "Keeper lets us use the features fully as a team without that barrier."

Since adopting Keeper, McBride CPAs has comfortably added new clients and expanded internal capabilities, exploring even more advanced Keeper features like the new integrated email system–Keeper Emails—as well as Keeper Receipts.

When asked about the value of Keeper overall, Kala had this to say:

"We are 100% completing our tasks faster than before. But even if we weren't doing it faster, we have peace of mind knowing things aren’t slipping through the cracks."

For Kala, this integrity paired with a reinforced confidence in her team’s work product is priceless. Keeper not only improves efficiency and accuracy, but also empowers McBride CPAs to consistently deliver the same level of professional, reliable service their clients trust.

Now, as McBride CPAs continues to expand and grow, Keeper remains central to the team’s operational strategy. "It's apparent to our clients: Keeper makes us look better and helps us deliver a better-quality product. And it’s at a really reasonable price,” Kala concluded. “So… I’m a Keeper fan forever!”

Curious to see what Keeper can do for your practice? Book a personalized demo today.